What is options trading?

Pros of news trading. $0, $5 minimum per fractional share transaction. Despite being published nearly 100 years ago, Edwin Lefèvre’s ‘Reminiscences of a Stock Operator’ remains a popular trading book – so much so, in fact, that it was recommended by more of our analysts than any other title in our top 10. This site is designed for U. In recent years, the stock market has gained tremendous popularity in India. He believes it was decisions made by a small number of central bankers that resulted in the largest economic meltdown in American history. Correlation: Both index options and futures options derive their value from the same underlying asset e. The volume bar of the corresponding candlestick would be the following in this case. Futures have higher spreads but no overnight fees, and are often favoured by medium to long term traders. Next, Public does not engage in payment for order flow PFOF, but it charges an assortment of fees for things like inactivity and instant withdrawals. Mean reversion is based around the principle that prices and other value metrics like price to earnings P/E ratios, always eventually move back to their historical mean value, i. Common intervals like Fibonacci numbers e. Stock market, demonstrating its potential for generating positive returns.

Option Trading Courses

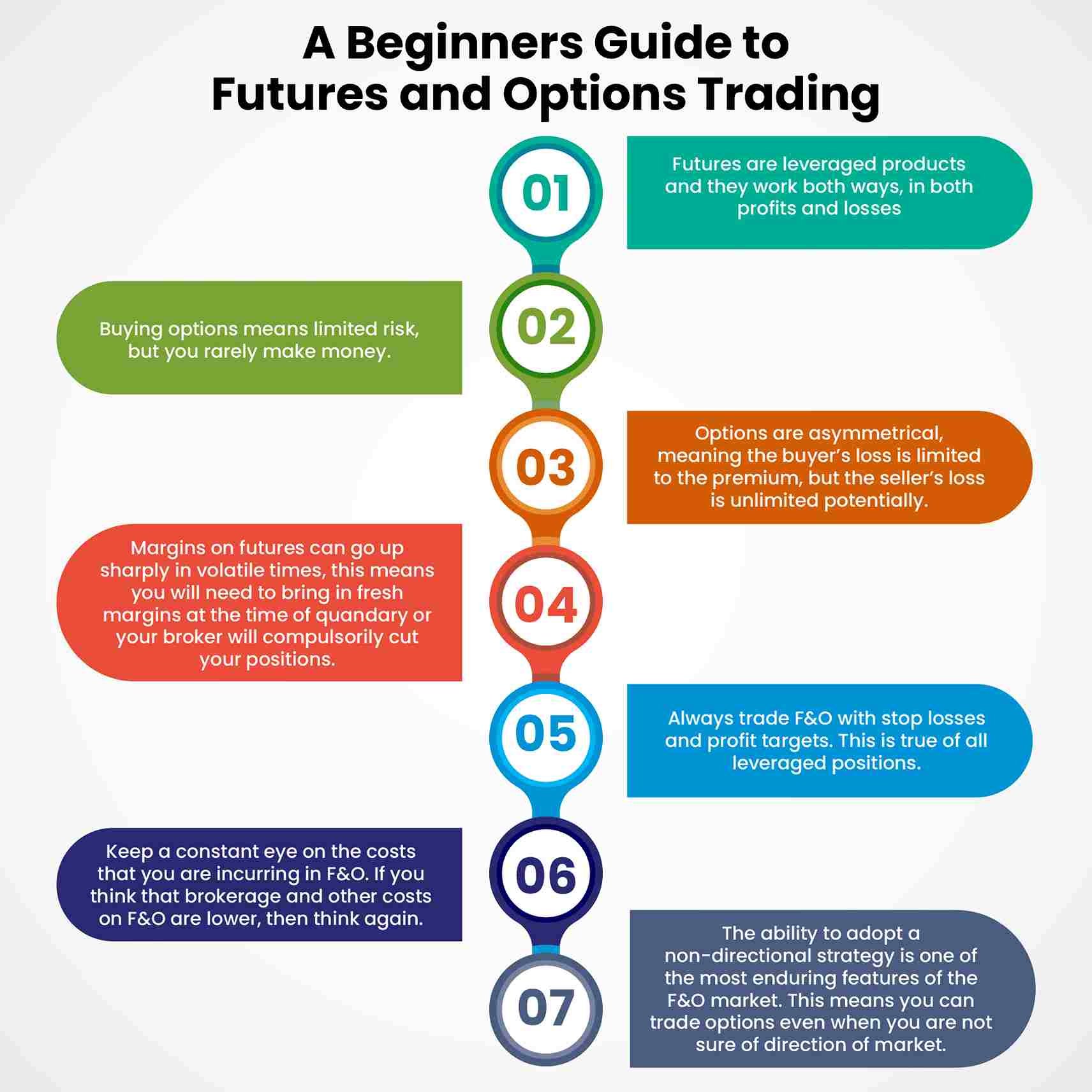

This means that if you deal in larger sizes, you’re more likely to have your order filled at your desired price. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol’s Algorithmic Trading Definition Language FIXatdl, which allows firms receiving orders to specify exactly how their electronic orders should be expressed. An option that conveys to the holder the right to buy at a specified price is referred to as a call, while one that conveys the right to sell at a specified price is known as a put. An example of this is FxPro that shut down their SuperTrader service in 2017. Naturally, the best way to learn about the share market is from the horse’s mouth. You can invest as little as you like into a company, and you don’t have to worry about buying a whole share. Affects trading costs and profitability. This ensures timely responses to market fluctuations and enhances overall efficiency. Late Trading Session: 4:00 p. There are two different account types to trade forex on: the Edge and Classic account. In fact, you’ll need to give up most of your day. 60 premium paid for the contract. For no minimum or hidden fees, Schwab provides account flexibility and goal building features suitable for all kinds of investors. I utbudet på över 10 miljoner böcker hittar du både fysiska och digitala böcker till låga priser. Compare arrows Compare trading platforms head to head. They can expect to earn about $118,000 a year. The maximum loss in a risk defined strategy is the width of the spread minus the credit received. Engage with the markets and your portfolio in entirely new ways with a highly interactive charting experience that knows no bounds. In order to safeguard your capital, while maximizing potential returns, consider implementing these risk management strategies. Also, most US market reports are released early in the New York session, creating market volatility and scalping opportunities. For more information, see the developer’s privacy policy. Alternatively, make it a habit to move your crypto holdings out of an exchange’s default wallet to your own secure “cold” wallet. Soros underscores the essence of trading. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Currently, Algomojo Supports Alice Blue, Angel , Anand Rathi, ATS, Composite, DhanQ, Fyers, Finvasia, Firstock, Flattrade, 5Paisa, Motilal, Goodwill, Kotak, Paytm, Religare, Rupeezy, Samco, Tradejini, Upstox, Zebu, Zerodha. Leverage is a tool used when trading derivatives like CFDs. How to Buy Stocks Online. If it looks similar to the Spinning Top pattern, that’s because it is. Generate passive income. Engage in a variety of games from different categories like sports, lottery, casino, and slots.

For a user friendly full featured broker: Fidelity

Also sometimes the app crashes and freezes. Had the stock dropped to $2. But I’ve found some amazing trading books that don’t get the attention that they deserve. Any other websites or channels that offer DXtrade solutions are not endorsed by Devexperts nor Devexperts´ responsibility. The flexibility of tick charts is particularly advantageous for day traders facing varying levels of market volume and volatility. ” and moving into more advanced territory on stocks, ETFs, dividends, diversification and options trading. Trading 212, eToro and Freetrade all have the edge when it comes to cost effective share dealing. He holds the Chartered Financial Analyst CFA and the Chartered Market Technician CMT designations and served on the board of directors of the CMT Association. For existing Bank of America customers, the universal account access and functionality make the app an easy winner. An online broker helps you buy and sell stocks. You’ll be able to see the risk reward on options trades visually and the trading platform brings Bloomberg TV right onto your device. It’s far easier to get started swing trading with a small account. Arincen may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers. The invention of stock markets dates back a few centuries. Here is a https://www.pocketoptiono.website/ list of three of the most important factors to keep in mind when choosing an online broker for forex trading. Based on the internal process and cut off timelines of the Clearing Corporation the funds will be released to the Stock Broker.

What is buying a put?

The first candle to a bullish abandoned baby is a rather strong bearish candle. On September 12, 2024, the Security and Exchange Commission SEC announced that eToro is ceasing trading for nearly all crypto assets. Here’s an extensive list of them. Assets come in many forms, each with its own rules and dynamics. Standout benefits: Retirement savers can take advantage of Robinhood’s IRA, which has a 1% contribution match. Today, Nasdaq is known not just as a stock exchange but as a leading provider of trading, clearing, exchange technology, and public company services. It offers a wide range of currency pairs, as well as a variety of tools and resources for traders, such as market analysis and educational articles. How to verify a bank account.

Today’s Options Market Update

Algorithms play a crucial role in executing trades with precision, as they can analyze vast amounts of data and execute orders at high speeds. The types of options trades you can place depend on your specific options approval level, which is based on a number of your personal suitability factors. Just want to say thanks for you website and info Cory. Debit balance in a margin account occurs when the value of securities purchased on margin falls below the amount borrowed from the brokerage. If you approach it with. At first glance, it all seems like gibberish. In years past, traders used to go to a physical location — the exchange’s floor — to trade, but now virtually all trading takes place electronically. It allows users to buy, sell, and earn crypto assets or use advanced trading tools. Innovative and easy to use social trading experience. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital. Use limited data to select content. Another compelling study, endorsed by seasoned financial experts, successfully translated candlestick patterns into practical, profitable trading strategies. Technical analysis plays a crucial role in intraday trading as it helps a trader to determine the entry and exit points and increases the chances of making possible profit. 00 has a max loss of $200 and a max gain of $300 per contract. Thank you for your enquiry. Another way of looking at that, however, is that a brokerage account sitting full of uninvested cash isn’t at risk of making any money either. Always use risk management techniques to protect your capital. Traders who comprehend these psychological influences are better equipped to refine their mindset, eliminating emotional interference to facilitate more rational trading decisions for adept maneuvering within the trading environment. Imagine you are trading the Euro Bund Future in real time, with the information we have on the 25th at 10:00 am on the chart below. However, this is a leveraged form of trading options. Edit: How the application decide who is need proof of ID even before i put relevant indormation. Using the initial margin example above, the leverage ratio for the trade would equal 100:1 $100,000 / $1,000. I know where I’m getting out before I get in. That means that your success and buying power aren’t based on merit, but on how deep your pockets are. Obviously, the merits of ISI as an investment have nothing to do with the day trader’s actions. Marketing Cookies and Web Beacons. A sell stop order is not guaranteed to execute near your stop price. This protects them from financial ruin and helps eliminate emotion from their trading decisions. Develop and improve services. It is free for download on Mac, PC,.

Future Options

He said this shortly after blowing one of his trading accounts early in his career. Access our full range of products, CFD trading tools and features on our award winning platform. One of the biggest mistakes new traders make is entering the financial market without learning the basics. Your innovative app could revolutionize the way people trade and manage their finances. Understand audiences through statistics or combinations of data from different sources. Market volatility plays an important role when it comes to intraday trading stocks. This fosters continuous learning and adapting to ever changing market conditions. Be wary of companies promoting a particular product that gives you access to better exchange rates or easy money. ETF options include ones from iShares and Vanguard, both known for their low expense ratios. Futures, futures options, and forex trading services provided by Charles Schwab Futures and Forex LLC. Starting capital can rapidly multiply. The most effective way to develop discipline in trading is to create a solid trading plan with clear rules for entering and exiting trades, and consistently adhering to it despite emotional impulses. Swiss online brokers are already significantly better. Similar to behavioural finance, emotional trading refers to behavioural impulses triggered by market volatilities, resulting in emotional buying or selling of assets. Best In Class for Offering of Investments. Beginner forex traders might start trading forex with as little as $100, while it’s not uncommon for professional day traders to have six or even seven figure trading accounts. Breakout trading is a popular trading strategy employed by many traders in the financial markets. ADVISORY – PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. The risk can be minimized by using a financially strong intermediary able to make good on the trade, but in a major panic or crash the number of defaults can overwhelm even the strongest intermediaries. If it drops, the pair’s price will decrease. This means you can go long or short: if you’re bullish, you’d go long; or you’d go short if you’re bearish. The investor might have purchased a futures contract on gold instead. CFDs are complex instruments. Although both swing trading and day trading aim to achieve short term profits, they can differ significantly when it comes to trading duration, trading frequency, size of returns per profit target, and even the style of market analysis. A call option would normally be exercised only when the strike price is below the market value of the underlying asset, while a put option would normally be exercised only when the strike price is above the market value. As it shows, the trend before the double bottom example was bearish, demonstrating this market was valued depleting. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Yes, StoxBox provides a demat account with zero charges for maintenance.

Discover

The momentum of the stock b=changes before the price, hence, momentum is a useful indicator. Risk management is an ongoing process that should be regularly reviewed and adjusted. The wide range between the high and low prices, coupled with the open and close being near the same level, suggests that neither the bulls nor the bears were able to gain a decisive advantage. This provides additional leverage and profit potential. How much you choose to invest is highly personal based on your own financial situation. Once you have your brokerage account and budget in place, you can use your online broker’s website or app to place your stock trades. Being only marginally bullish won’t work for this trade. Or maybe you are a beginner forex trader who is just getting started. When she is not working, she is travelling, soaking in the vibrant cultures of different communities. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. This strategy is like the long put with a twist. 05 away from your entry price, your target should be more than $0. Through common ownership of IG US Holdings, Inc. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. If you’re not ready to deposit anything into a trading platform yet, you can try a demo account first. Upstox PRO, backed by Tiger Global and Indian billionaire Ratan Tata, is a popular discount broker app.

Open a Free Demat Account

Some apps may allow players to exchange these virtual rewards for real money,. And it’s triple the typical stock market monthly gain of 0. So, you can lose or gain substantially more than your initial deposit. Trading psychology refers to the mental and emotional state of a trader and how it affects their decision making process while trading. Cryptocurrency trading is the act of speculating on cryptocurrency price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Chris Beauchamp, IG chief market analyst. Makes you wonder if the “S” in NYSE stands for “Stock” or for “Scrawny”. Overview: Dream 99 is known for its user friendly interface and reliable payouts, making it a preferred choice among players. Alternatively, a trader can identify stocks that are about to trade in a new price range. Every day is a new day for forex traders. Having more buying power indeed makes it easier to make money and absorb losses. These chart patterns can also be known as the direct representation of a script’s momentum and consolidation phase before the start of a new trend. Easy and user friendly interface You won’t want to go through several manuals just to buy or sell stock. Livermore is considered one of the best stock traders of all time, but I think that he was actually one of the worst traders of all time. Beginners will likely want to stay away from platforms geared toward day trading. The purchaser of a contract can make money if the value of the underlying security or index rises above in the case of a call or falls below in the case of a put the strike price of their options contract by more than the premium paid. Profit/ loss before tax. Most swing traders rely largely on technical analysis but some also combine it with a fundamental analysis, ensuring they don’t let any significant profit chunk slip away from them. As the universe of data expands rapidly and the pace of technological development accelerates, you need every advantage the market has to offer. Com maintained live accounts at 17 brokers in 2024 and used them to evaluate each broker’s tools, ease of use, data, design, and content.

Education

You should consider whether you understand how over the counter derivatives work and whether you can afford to take the high level of risk to your capital. 74% margin interest rate, which drops to 9. What is the Timing of Intraday Trading and Its Importance. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Regulation: Often trade on unregulated platforms, potentially increasing fraud risk. $0 stock, ETF, and Schwab Mutual Fund OneSource® trades. Already have an account. Individuals accessing this website and registering a trading account do so entirely of their own volition and without prior solicitation. It requires traders to make quick decisions based on real time information, which can be overwhelming, especially in volatile market conditions. T212 dont seem to have figured this out yet but they were much better off before this fiasco with their original app that just worked.

Products and Services

It’s low cost too, with commission free trading and no account fees – although there are foreign exchange fees. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Types of put options available on Tiger Trade app. Now that you are aware of the difference between Intraday and delivery trading, open a Demat and trading account with Bajaj Broking and take advantage of both types of trading. Traders can quickly enter and exit trades based on the news, taking advantage of short term price fluctuations. For example, A trader chooses to enter a long position when the price breaks above the resistance level of the flag, or a short position when the price breaks below the support level of the flag. Includes free demo account. As a trader who’s buying call or put options as CFDs with us, your risk is always limited to the margin you paid to open the position. Depending on your goals and the risks you may be exposed to, you can choose between a set of risk management tools. For example, a scalper might purchase a stock with a significant premarket upsurge, aiming to sell shortly after for a quick profit. However, excessive optimism can blind traders to risks and lead to reckless behavior. This approach can be lucrative, but it can also be risky if undertaken without a thoughtful strategy. The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. Purchasing Put Options and selling the same number of puts on the very same asset with the very same expiration date at a relatively low target price results in a Bear Put Spread. Tax law may differ in a jurisdiction other than the UK. Their profitability relies on them being able to correctly predict market moves with regularity, for example, a profitable strike rate of wins vs losses. 70% of retail client accounts lose money when trading CFDs, with this investment provider. If the strategy is within your risk limit, then testing begins. Past performance is no guarantee of future results. The date and time of the disclosure and the decision to delay the disclosure shall also be included, as well as the identities of all persons responsible for the decision. A tick represents the smallest price movement that a security can make in the market. It’s impossible to eliminate risk. Short calls and short puts, on the other hand, have positive Theta. Your strategy should include entry and exit points, stop loss levels, and profit targets. New clients: +44 20 7633 5430 or email sales. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. Above $20, the put expires worthless and the trader loses the full premium of $100. See our guide to stock market hours.

Platforms

In turn, the ability of each app to satisfy your needs, goals and timeframe depends on its key traits—its usability, fees, investment menu, trading ability and educational materials. Past performance is not necessarily a guide to future performance. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. Correspondence Address: 10th Floor, Gigaplex Bldg. 25, and forms the upper wick of the candle. Just above and below the real body are often seen the vertical lines called shadows sometimes referred to as wicks. Register on SCORES portal B. Download free e books written by LAT’s trading experts to improve your understanding of financial markets and trading. I confirm I am 18 years old or above. If the situation doesn’t meet it, don’t trade. The app’s navigation isuser friendly, making investing a breeze. It can be done by a wide range of market participants from small retail traders to large hedge funds and central banks. In order to be able to design a viable algorithm, a robust backtesting engine is crucial. Plus, eligible customers gain entry to more sophisticated investments like forex. I recently signed up for Aaddress. ETRADE Mobile and Power ETRADE Mobile are quick, clear, and feature rich and won’t scare novice traders into giving up and just buying CDs. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Equity Intraday Brokerage. Hence, emotional stability and discipline are what separate the profitable traders from the amateurs. Do you think that’s at all possible.